Stop IRS Levy in Phoenix, Arizona

Let Scott Allen EA Represent You: Stop IRS Levy in Phoenix, Arizona

Facing an IRS levy in Phoenix, Arizona can be an overwhelming and stressful experience for anyone. The Internal Revenue Service (IRS) has the power to seize your assets, garnish your wages, and freeze your bank accounts if you have outstanding tax debts. However, residents of Phoenix, Arizona, can find solace in the expertise of Scott Allen EA, an enrolled agent who specializes in representing taxpayers before the IRS. In this blog post, we will explore the process of stopping an IRS levy in Phoenix and how Scott Allen EA can assist you in navigating this complex situation.

Understanding IRS Levy and Its Consequences:

When a taxpayer fails to pay their tax debts, the IRS can resort to levying their assets. An IRS levy is a legal seizure of a taxpayer’s property to satisfy the outstanding debt. This can include bank accounts, wages, real estate, vehicles, and other assets of value. The consequences of an IRS levy can be severe, leading to financial distress, strained relationships, and significant disruptions to one’s life.

How to Stop an IRS Levy In Phoenix, Arizona:

Halting an IRS levy requires prompt action and a thorough understanding of the tax laws. The following steps can help individuals in Phoenix, Arizona, stop an IRS levy and protect their assets:

- Seek Professional Assistance: Handling an IRS levy situation can be complex, and it’s crucial to consult a tax professional like Scott Allen EA. As an enrolled agent, Scott Allen EA possesses the necessary knowledge and experience to navigate the intricacies of tax laws and negotiate with the IRS on your behalf.

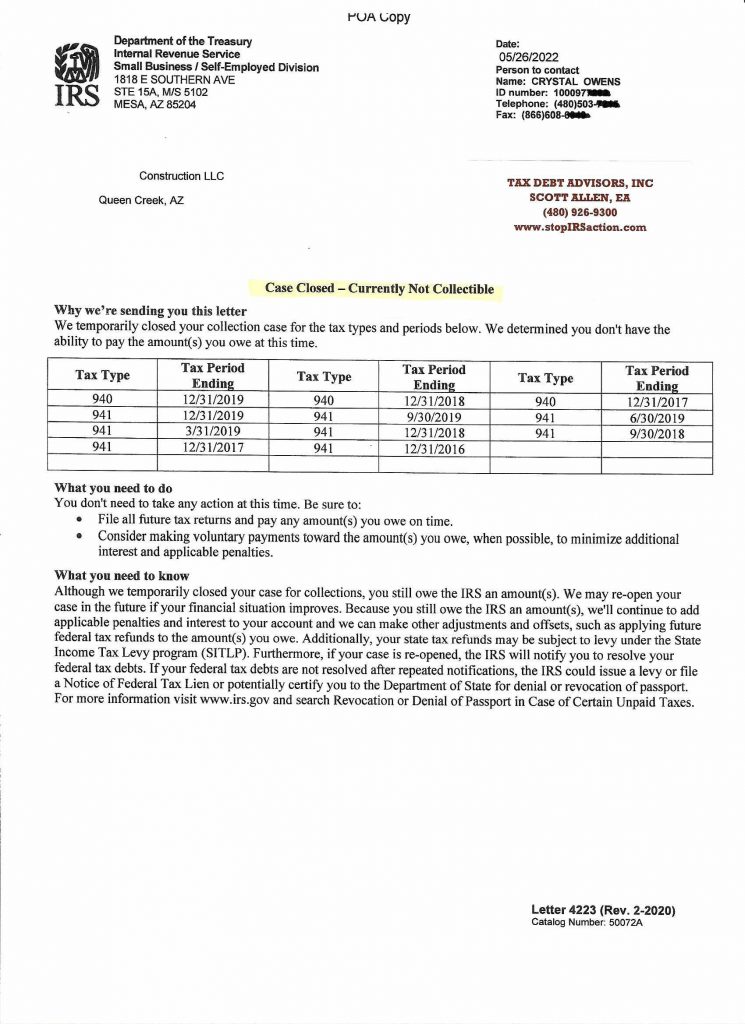

- Communicate with the IRS: Open lines of communication with the IRS are essential. Scott Allen EA can serve as your representative, ensuring effective communication with the IRS agents. Through skillful negotiation, he can present your case and explore potential alternatives to levy, such as installment agreements, offers in compromise, or currently not collectible status.

- File for a Collection Due Process (CDP) Hearing: If the IRS has issued a Final Notice of Intent to Levy, you have the right to request a Collection Due Process hearing. This formal procedure allows you to present your case before an independent appeals officer. Scott Allen EA can guide you through this process, gather the necessary documentation, and represent you effectively at the hearing.

- Explore Legal Remedies: In some cases, legal remedies may be appropriate, such as filing for a tax bankruptcy or pursuing an innocent spouse relief claim. Scott Allen EA can assess your circumstances and provide guidance on the best course of action to stop the IRS levy while minimizing the impact on your financial situation.

The Benefits of Scott Allen EA’s Representation:

Scott Allen EA offers numerous advantages to individuals who need to Stop IRS levy in Phoenix, Arizona:

- Extensive Experience: With years of experience as an enrolled agent, Scott Allen EA possesses in-depth knowledge of tax laws, IRS procedures, and effective negotiation strategies. He has successfully represented numerous clients in resolving their tax issues and stopping levies since 2007. His family business, Tax Debt Advisors, Inc have been solving IRS problems since 1977.

- Personalized Guidance: Scott Allen EA understands that every case is unique. He provides personalized attention to each client, thoroughly assessing their financial situation, and devising tailored solutions to halt the IRS levy. His compassionate approach ensures that clients feel heard and supported throughout the process.

- Expert Negotiation Skills: Negotiating with the IRS requires skillful communication and a deep understanding of tax laws. Scott Allen EA’s expertise in this area allows him to effectively present your case, explore alternative options, and negotiate on your behalf to reach a favorable resolution.

- IRS Compliance and Tax Relief: Beyond stopping the immediate levy, Scott Allen EA can assist you in achieving long-term IRS compliance. He can guide you in implementing tax planning strategies, ensuring accurate filings, and exploring potential tax relief programs to minimize future tax liabilities.

Needing to stop IRS levy in Phoenix, Arizona, can be a daunting situation, but it’s important to remember that you don’t have to face it alone. Scott Allen EA is a trusted professional who specializes in representing taxpayers before the IRS. With his extensive knowledge, experience, and personalized approach, he can help you navigate the complexities of the tax system and stop an IRS levy. By seeking Scott Allen EA’s representation, you can gain peace of mind and protect your assets while working towards resolving your tax debt issues effectively.

A real Testimonial:

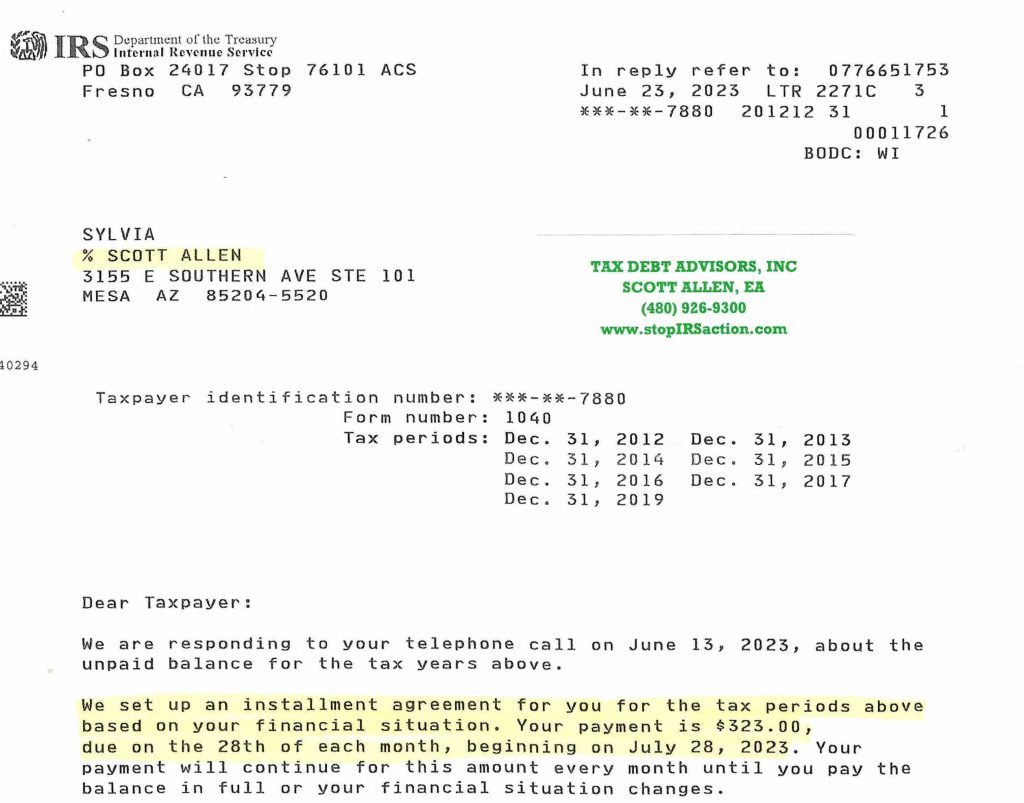

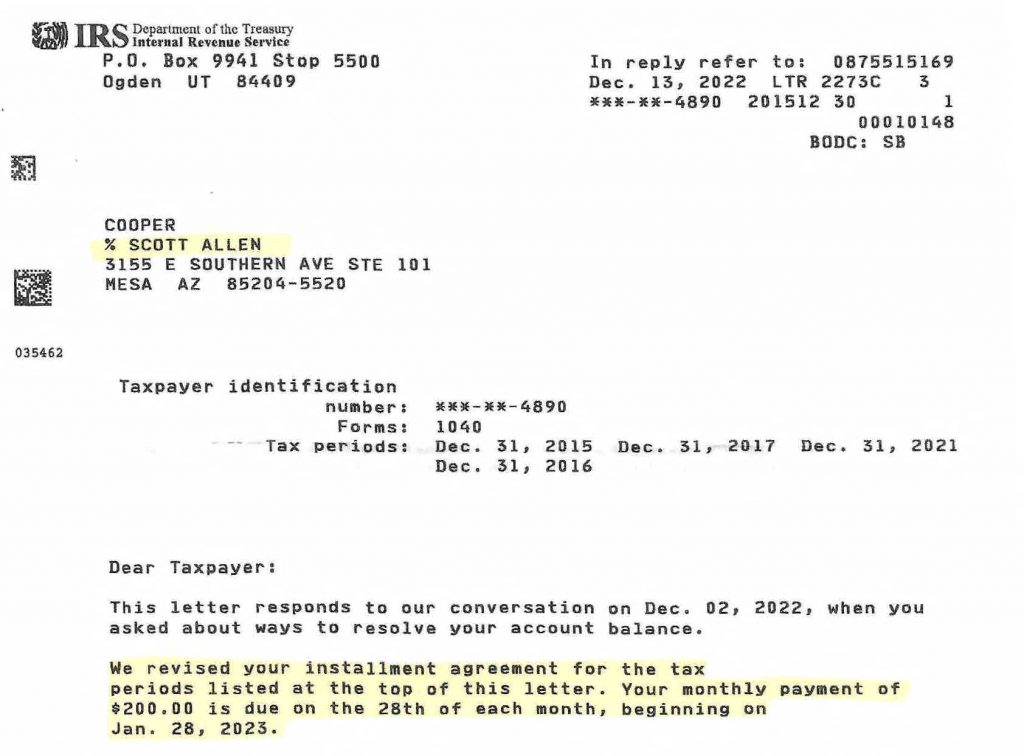

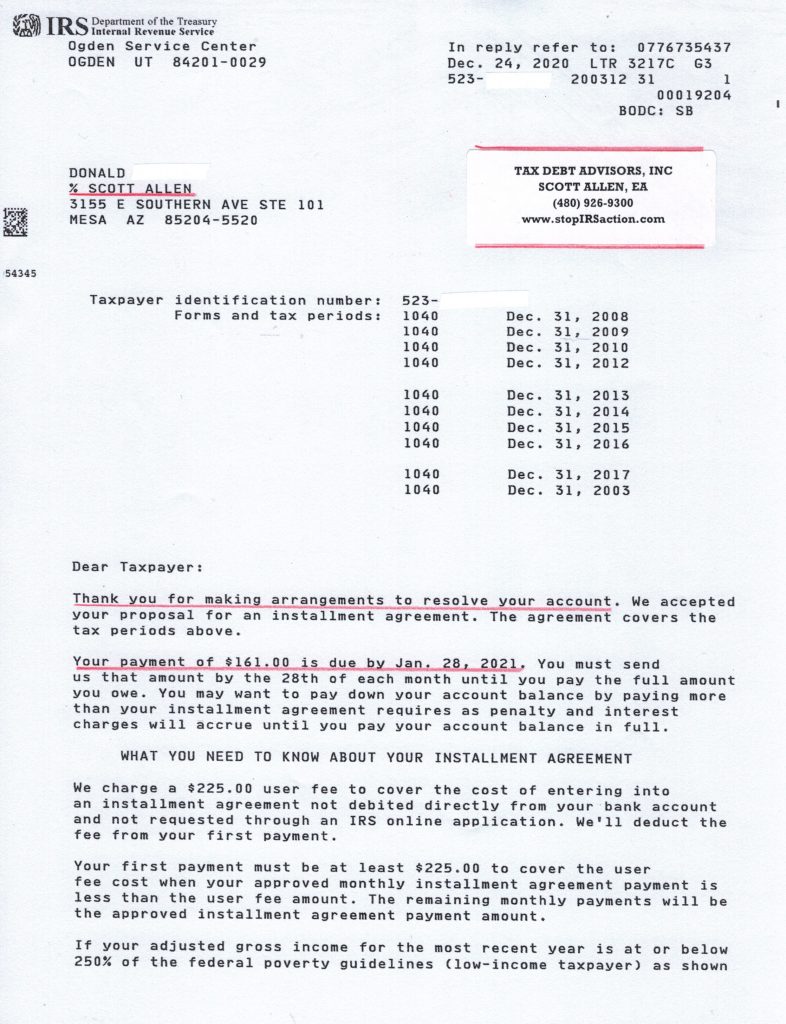

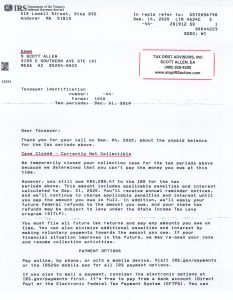

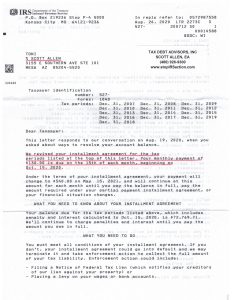

Veiw a recent example below of Scott Allen EA of Tax Debt Advisors, Inc was able to stop IRS levy in Phoenix, Arizona for Sylvia by negotiating seven years of back taxes owed into one low monthly payment plan.

Stop IRS Levy in Phoenix Arizona