Ashlee’s Monthly IRS Payment Plan Mesa AZ

How Tax Debt Advisors, Inc. Helped Ashlee Resolve IRS Back Tax Debt on a $120 Monthly Payment Plan in Mesa, Arizona

Tax Debt Advisors, Inc., a Mesa-based family owned firm specializing in assisting individuals with tax-related issues, recently accomplished a significant breakthrough in resolving the IRS back tax debt of their client, Ashlee. Facing a daunting amount in back taxes owed to the IRS, Ashlee turned to Tax Debt Advisors, Inc. for guidance and support in navigating this challenging situation.

Ashlee’s predicament stemmed from accumulating tax debt over several years, creating a substantial financial burden. Fearing the mounting penalties and the IRS’s relentless pursuit, she sought professional help to find a feasible solution and gain control over her finances once again.

Upon her initial consultation with Tax Debt Advisors, Inc., Ashlee was immediately met with Scott Allen EA, a seasoned tax professional committed to understanding her situation and crafting a personalized strategy. The firm’s adept advisors meticulously assessed Ashlee’s financial records, evaluating her tax liabilities, income, and expenses to devise a viable resolution plan.

Scott Allen EA at Tax Debt Advisors, Inc. worked diligently on Ashlee’s case, leveraging their expertise and deep understanding of tax laws and IRS procedures to negotiate on her behalf. Their primary goal was to reach an agreement with the IRS that would alleviate Ashlee’s financial strain and provide her with a sustainable repayment plan.

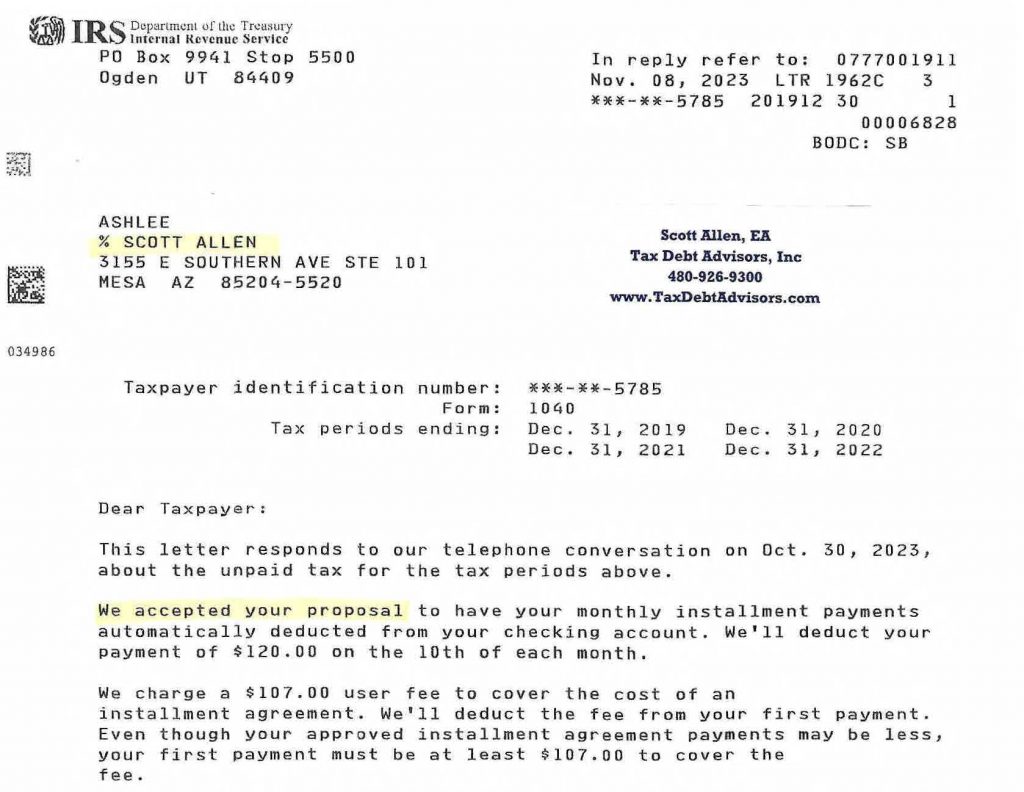

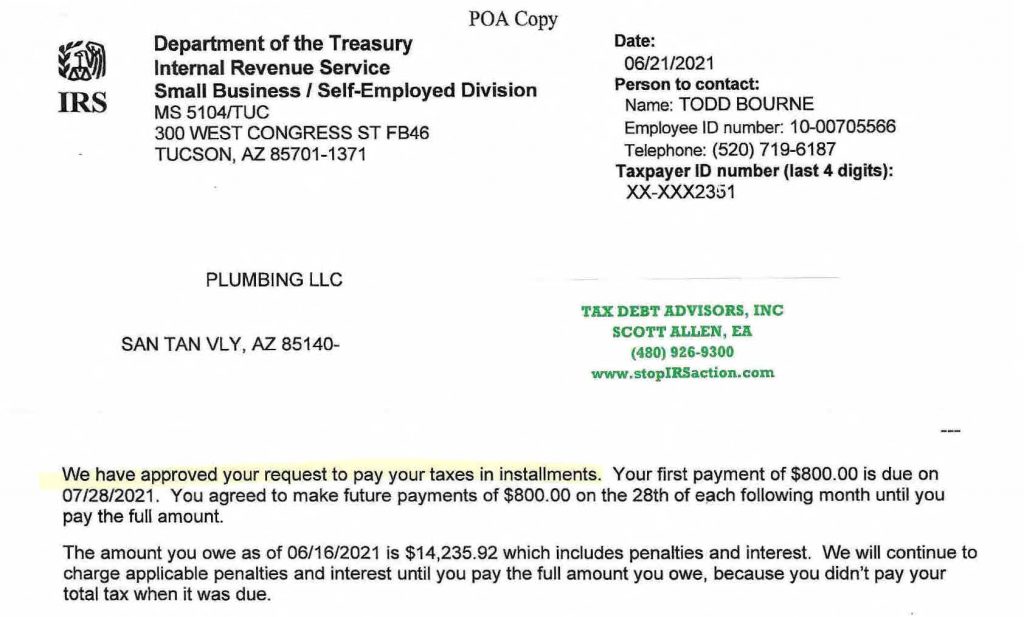

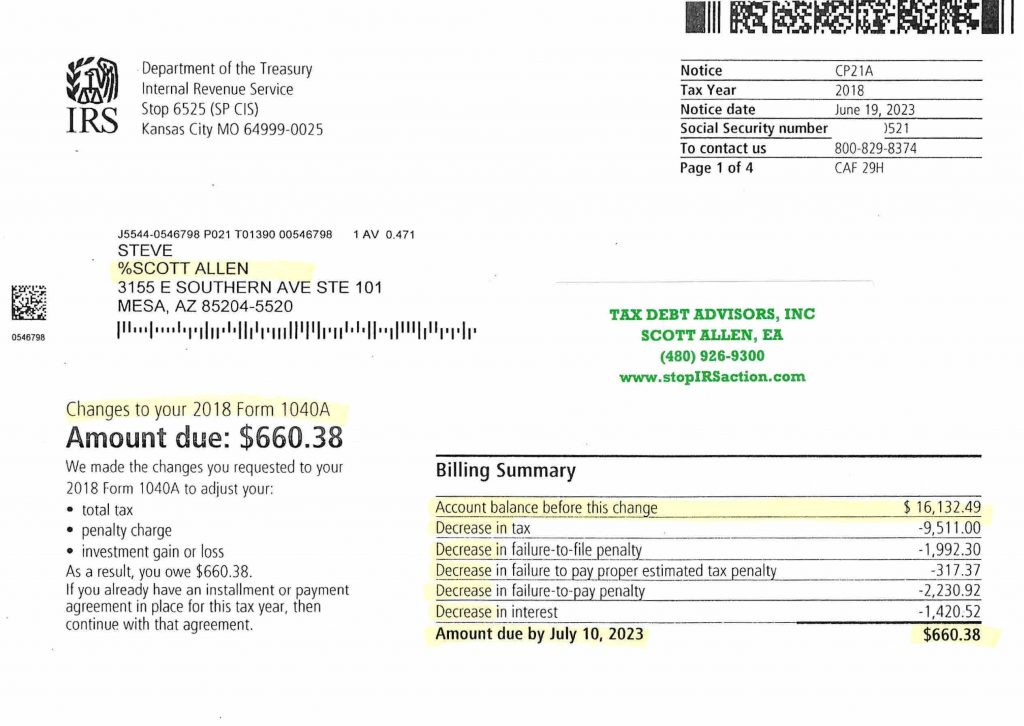

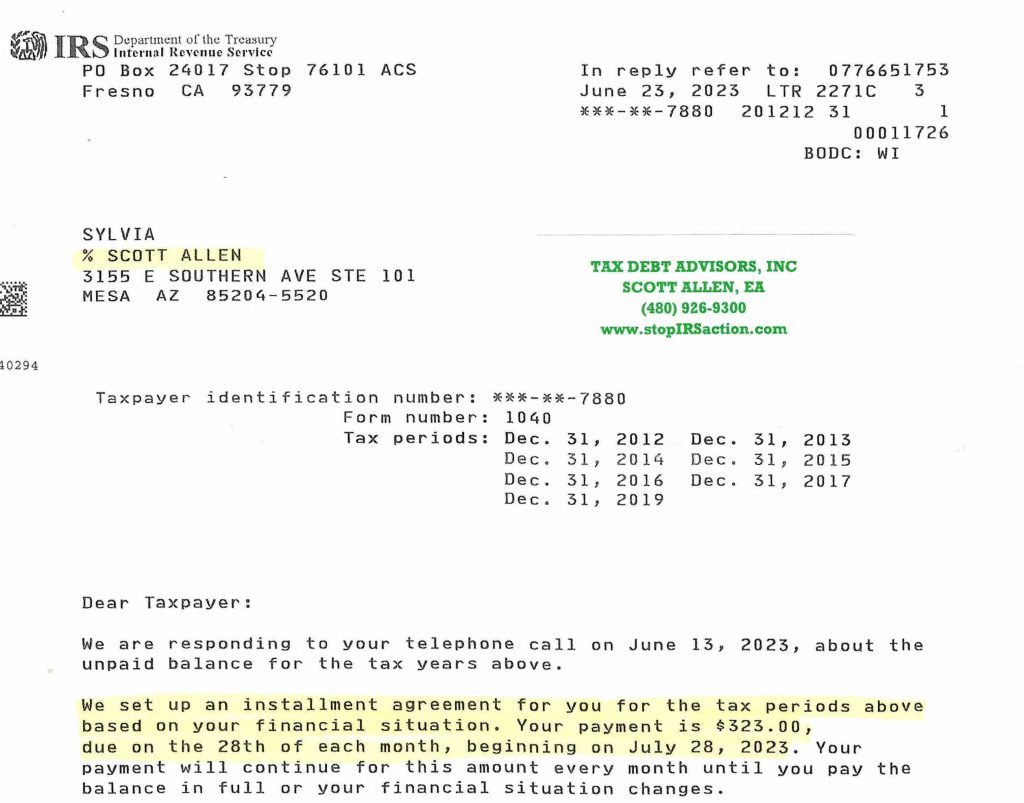

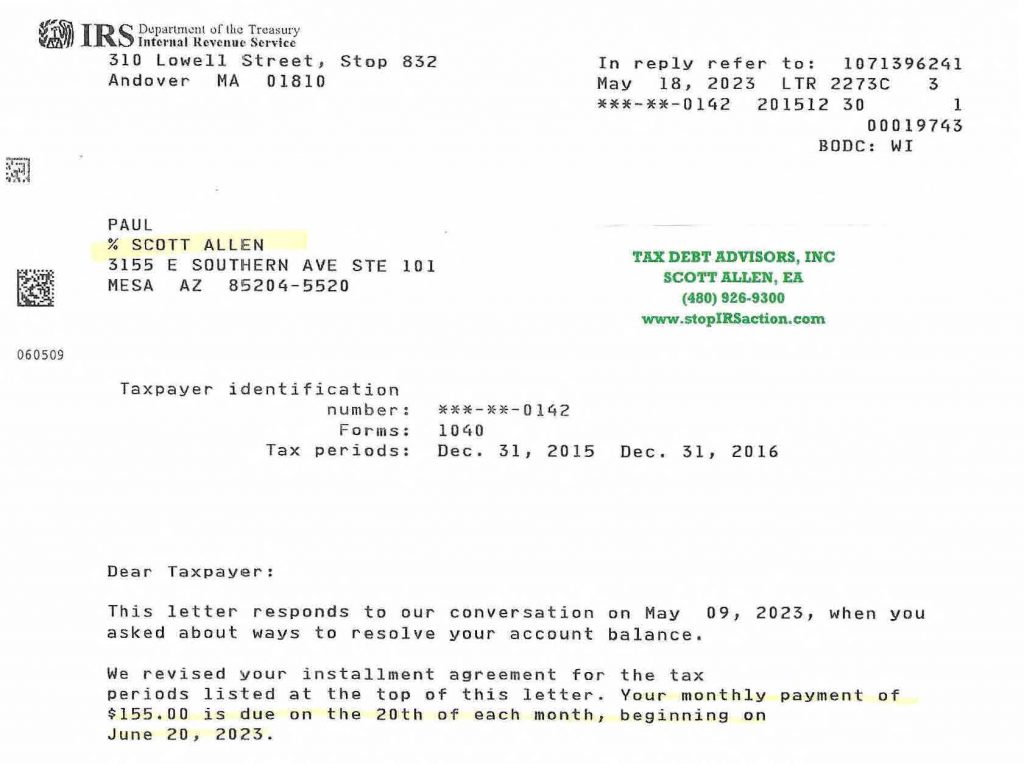

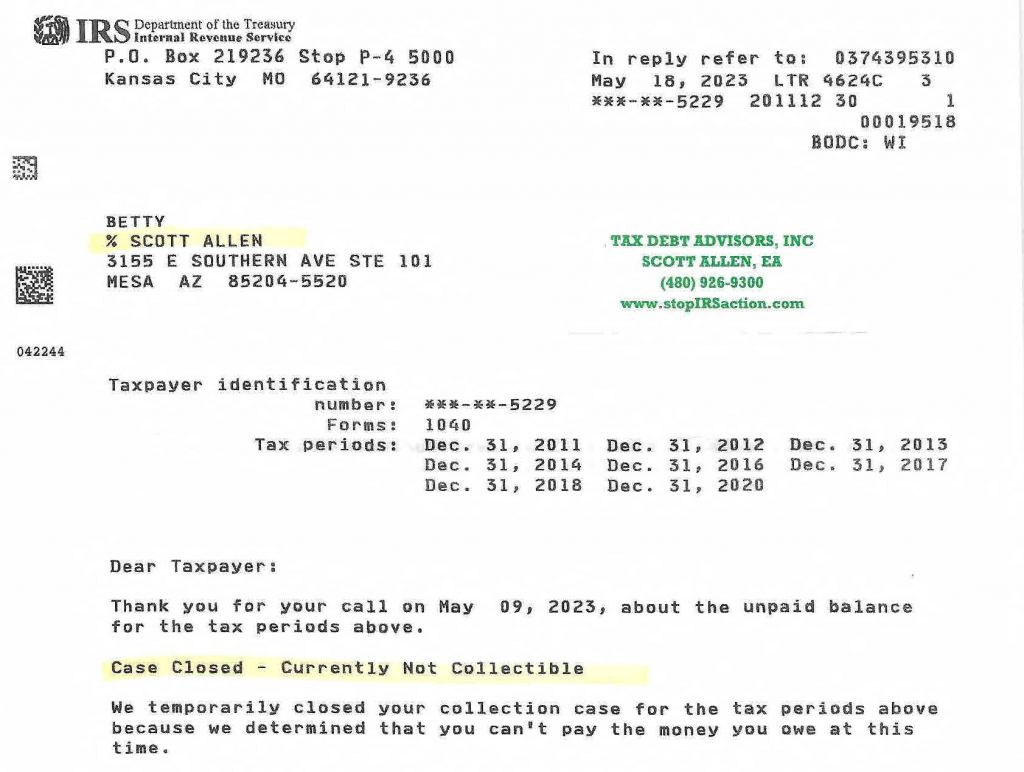

Through persistent negotiations and meticulous advocacy, Tax Debt Advisors, Inc. successfully secured an agreement with the IRS to settle Ashlee’s substantial back tax debt. The achievement was remarkable as the negotiated resolution allowed Ashlee to pay a reduced amount of $120 per month towards her tax debt until it gets paid off.

The tailored payment plan not only alleviated the immediate financial burden but also provided Ashlee with a structured pathway towards clearing her tax obligations. The team at Tax Debt Advisors, Inc. continued to support and guide Ashlee throughout the implementation of the payment plan, ensuring compliance and adherence to the agreed terms.

The success story of Ashlee’s tax resolution with the help of Tax Debt Advisors, Inc. underscores the importance of seeking professional assistance when dealing with IRS back tax debt. Their comprehensive approach, expertise in negotiation, and dedication to client success played a pivotal role in achieving this favorable outcome.

Furthermore, beyond the financial relief, Ashlee expressed her gratitude for the compassionate and personalized support she received throughout the process. Scott Allen EA not only provided expert guidance but also reassured Ashlee, alleviating the stress and anxiety associated with her tax debt predicament.

The resolution of Ashlee’s case stands as a testament to the commitment of Tax Debt Advisors, Inc. to assist individuals in overcoming complex tax challenges effectively. By tailoring solutions to individual circumstances and advocating on behalf of their clients, they empower individuals like Ashlee to regain control of their financial futures.

The successful resolution of Ashlee’s back tax debt to a manageable IRS payment plan Mesa AZ of only $120/month through Tax Debt Advisors, Inc. exemplifies the firm’s dedication, expertise, and commitment to providing comprehensive solutions for clients grappling with IRS tax debt issues. This case study serves as a beacon of hope for individuals facing similar challenges, showcasing that with the right guidance and advocacy, daunting tax debts can be effectively managed and resolved.

Tax Debt Advisors, Inc.’s unwavering commitment to client success and their ability to navigate complex tax matters continues to make a meaningful impact on individuals striving to overcome IRS tax debt challenges in Mesa, Arizona, and beyond. Below is a copy of the agreement letter from the IRS with the approved payment plan. See for yourself!