Unveiling Tax Debt Advisors, Inc.’s Filing Back Taxes in Mesa, Arizona

Navigating Tax Challenges: Unveiling Tax Debt Advisors, Inc.’s Process for Filing Back Taxes in Mesa, Arizona

Tax season can be a stressful period for individuals and businesses alike, especially when dealing with back taxes. Unresolved tax issues can lead to a multitude of problems, including penalties, interest, and even levy and garnishment actions. In Mesa, Arizona, Tax Debt Advisors, Inc. has established itself as a reliable partner in helping individuals and businesses navigate the complex process of filing back taxes. With their expertise and proven approach since 1977, they offer a tailored process that addresses each client’s unique situation, providing peace of mind and financial stability. This blog delves into Tax Debt Advisors, Inc.’s comprehensive process for filing back taxes in Mesa, Arizona.

-

Initial Consultation

The journey to resolving back taxes with Tax Debt Advisors, Inc. begins with an initial consultation. This step is crucial in understanding the client’s specific circumstances and financial situation. During the consultation, the client meets with Scott Allen EA who gathers information about their outstanding tax debt, income, expenses, and any relevant documentation. This comprehensive overview allows the tax experts at Tax Debt Advisors, Inc. to design a personalized strategy tailored to the client’s needs.

-

Document Collection and Analysis

After the initial consultation, the client is guided through the process of collecting and organizing all necessary financial documents. These documents include tax returns, income statements, bank statements, and any other relevant financial records. Tax Debt Advisors, Inc. understands the importance of accuracy and detail in this step, as it forms the foundation for the subsequent stages of the back tax filing process. While the taxpayer is working on this, Scott Allen EA will be reaching out to the IRS with his power of attorney authorization and gather up as much detailed info and tax records from them in case you have lost any of your records.

-

Assessment and Strategy Development

Once all the necessary documents are gathered, Scott Allen EA at Tax Debt Advisors, Inc. conduct a thorough assessment of the client’s financial situation. This involves a meticulous review of the collected documents to identify any errors, discrepancies, or opportunities for deductions. Based on this assessment, the team develops a comprehensive strategy that aims to minimize tax liability while adhering to the relevant tax laws and regulations in Mesa, Arizona.

-

Preparing and Filing Back Taxes

With a solid strategy in place, Tax Debt Advisors, Inc. begins the process of preparing and filing back taxes on behalf of their clients. This stage involves accurate calculations, meticulous completion of required forms, and adherence to strict deadlines. The team ensures that all necessary documentation is included and that the tax returns are filed correctly to avoid further complications.

-

Negotiation and Resolution

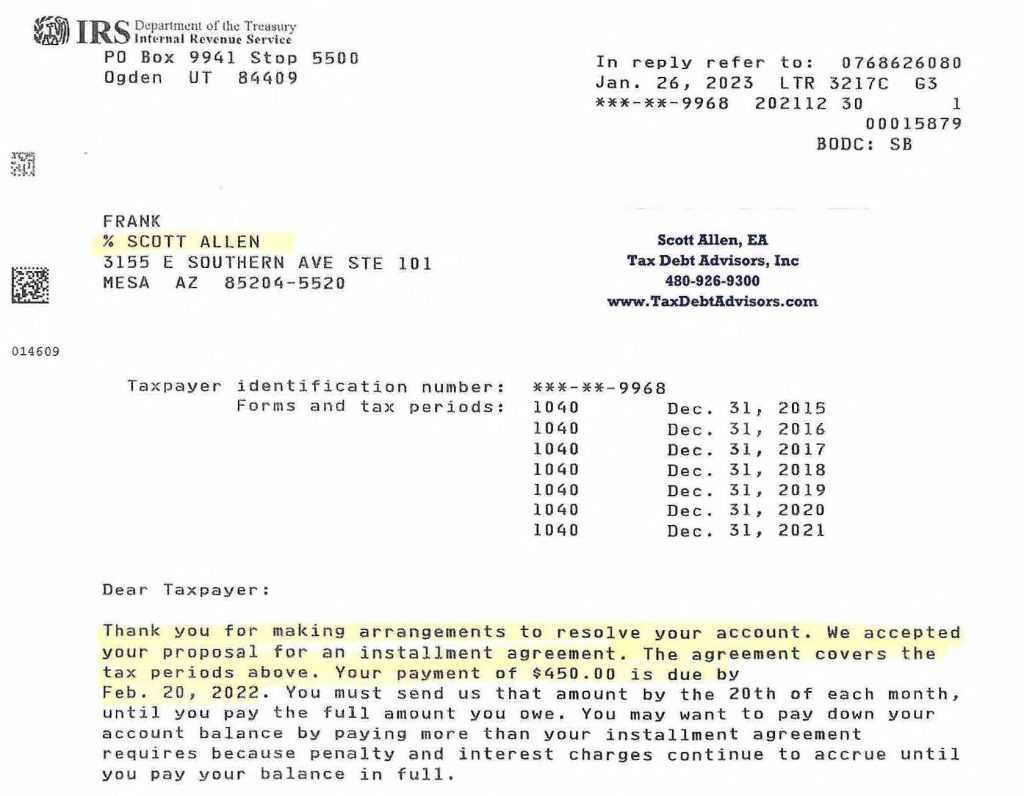

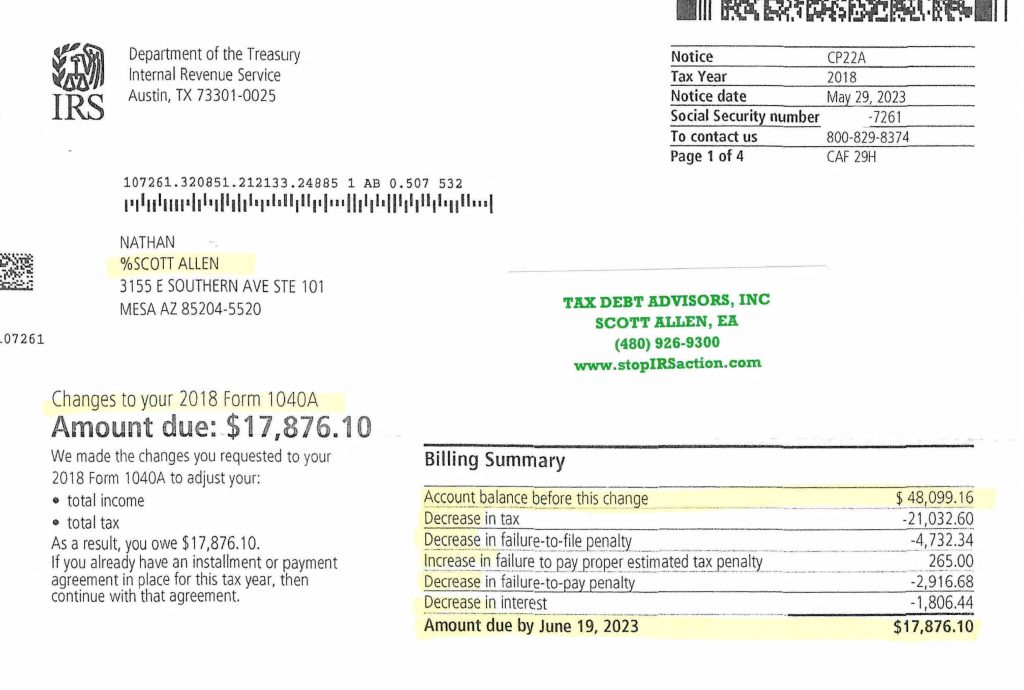

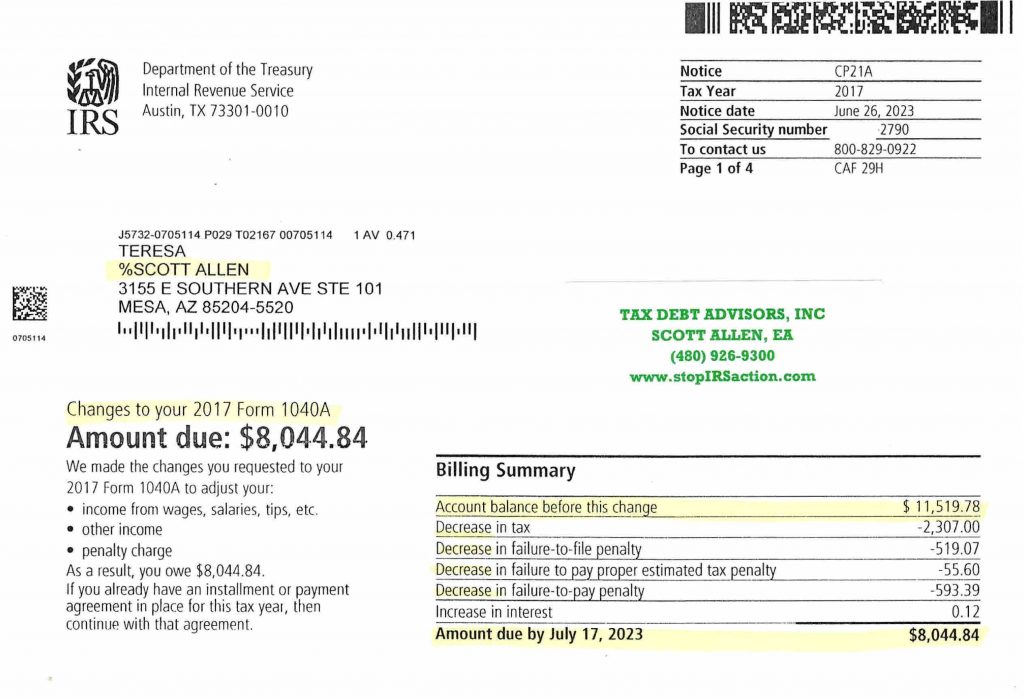

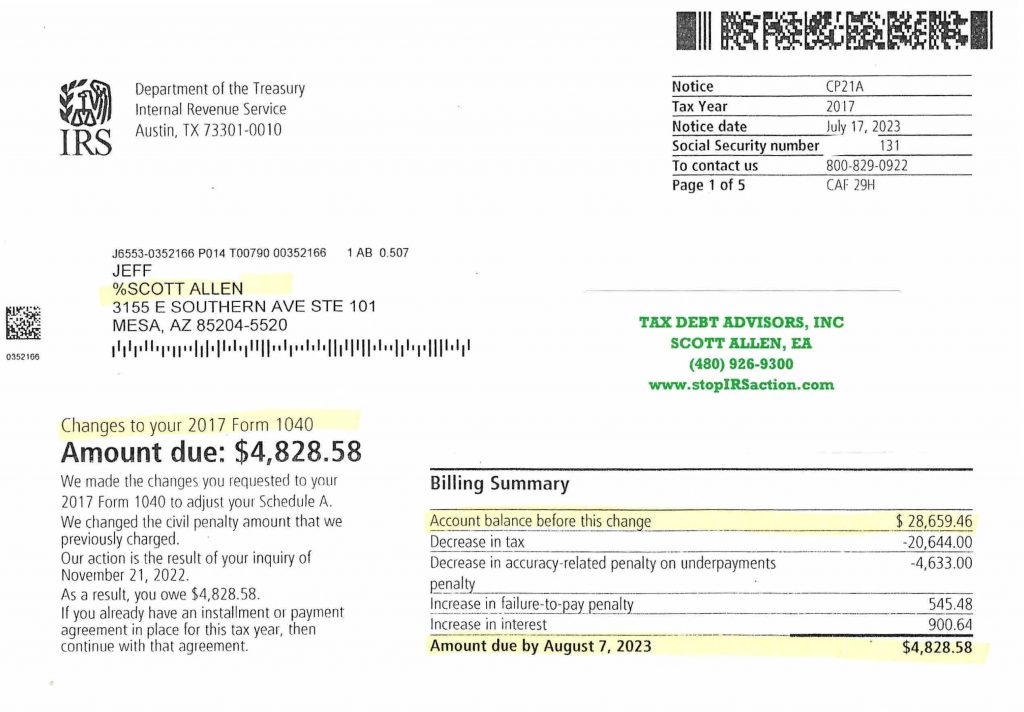

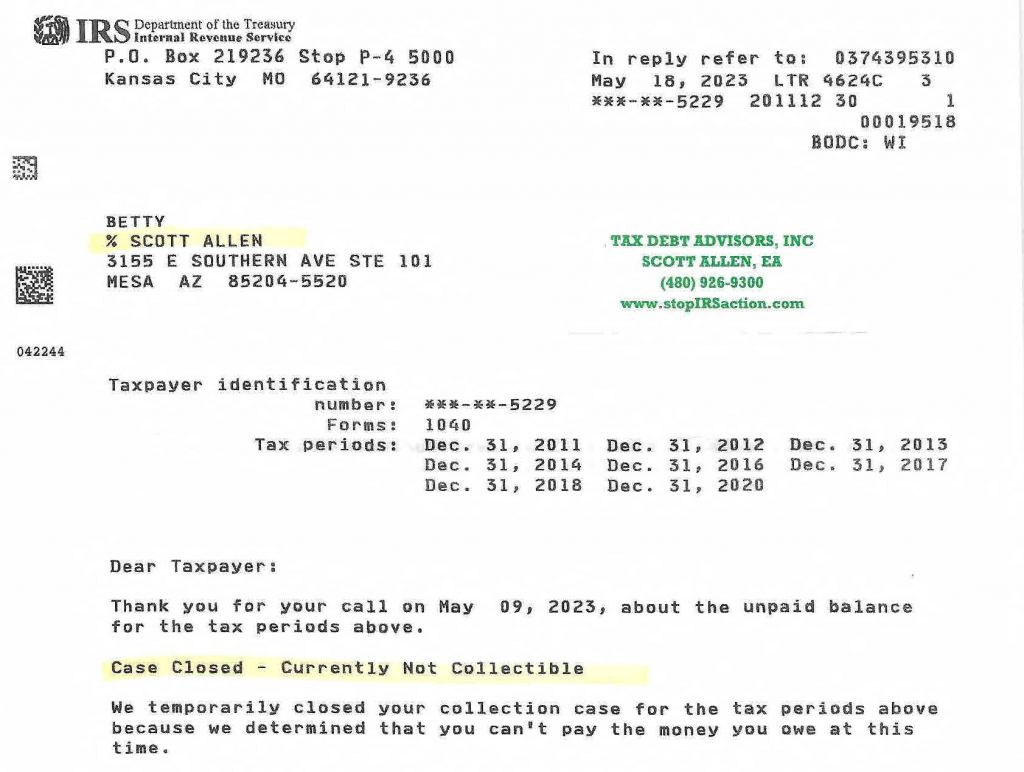

In cases where the client owes a substantial amount in back taxes, Tax Debt Advisors, Inc. leverages its negotiation expertise to work with tax authorities on the client’s behalf. This phase involves communicating with the appropriate tax agencies, exploring potential settlement options, and negotiating a resolution that is in the best interest of the client. The goal is to establish a manageable payment plan or potentially reduce the overall tax liability.

-

Communication and Client Support

Throughout the entire process, Tax Debt Advisors, Inc. maintains open lines of communication with the client. They provide updates on the progress of their case, address any questions or concerns, and ensure that the client remains informed and empowered throughout the journey. This commitment to transparency and support distinguishes Tax Debt Advisors, Inc. as a partner that genuinely cares about the financial well-being of its clients.

-

Ongoing Compliance and Future Planning

Once the back taxes are successfully filed and resolved, Tax Debt Advisors, Inc. goes a step further by offering guidance on maintaining tax compliance in the future. They provide valuable insights into record-keeping practices, tax-saving strategies, and financial planning to prevent similar issues from arising again. This comprehensive approach ensures that clients are better equipped to navigate their financial responsibilities moving forward. Scott Allen EA can now be your tax preparer moving forward on a yearly basis.

Filing back taxes in Mesa, Arizona can be a daunting process, but with the expertise and guidance of Tax Debt Advisors, Inc., individuals and businesses in Mesa, Arizona can find a way to regain control of their financial situation. By offering a personalized and comprehensive process that encompasses consultation, analysis, negotiation, and ongoing support, Tax Debt Advisors, Inc. stands out as a trusted ally in resolving tax challenges. Through their dedication to each client’s unique needs, they pave the way for a more secure and stable financial future.

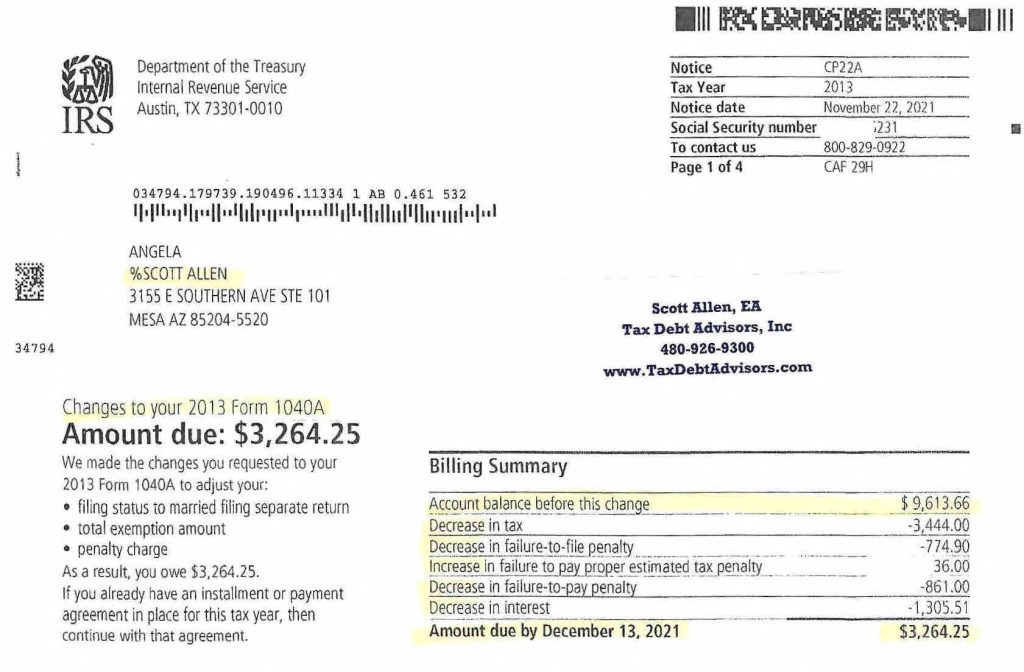

Below is just a recent example of Scott Allen EA following thru and having a victory for his client Angela. He was able to help her in filing back taxes Mesa Arizona and save her over $6,000. Let him go to work for you!